The Weekly Market Commentary 10.09.2023

The Markets

Financial markets lost ground during the third quarter.

While year-to-date returns for the Standard & Poor’s (S&P) 500 Index remain above the historic average, which was 10.24 percent, including dividends, from 1973 to 2022, the rally in U.S. stocks stalled during the third quarter of 2023, reported Lewis Krauskopf, Ankika Biswas and Shashwat Chauhan of Reuters.

Early in the quarter, U.S. stocks gained, driven higher by better-than-expected corporate earnings, falling inflation and optimism that the Federal Reserve (Fed) might be near the end of its rate-hiking cycle. Since March of 2022, the Fed has lifted the Federal Funds effective federal funds rate from near zero to 5.33 percent and reduced its bond holdings by $1 trillion through quantitative tightening, reported Michael S. Derby of Reuters.

The Fed’s actions are designed to bring inflation lower by slowing economic growth and reducing demand for goods and services. However, the U.S. economy continues to hum along. The labor market has been particularly resilient. Last week’s employment data showed number of jobs created in September was almost double the Dow Jones consensus estimate, reported Jeff Cox of CNBC. The U.S. unemployment rate remained near historically low levels, and the labor force participation rate increased over the quarter.

The strong economy has been a source of significant uncertainty. Some economists believe it is an indication the Fed has engineered a soft landing and inflation will reach targeted levels without a recession, although 60 percent of the economists surveyed by Bloomberg continue to say a recession is ahead, reported Rich Miller, Molly Smith and Kyungjin Yoo.

Government turmoil also has created uncertainty. In early August, Fitch Ratings surprised financial markets by lowering its rating on U.S. Treasuries from AAA to AA+. The company indicated that “a high and growing general government debt burden, and the erosion of governance” were the impetus for the downgrade.

In September, when Congress debated whether to approve the necessary appropriations bills to fund the U.S. government for fiscal 2024, Moody’s Investors Service – the only remaining major credit rating agency to award U.S. Treasuries a AAA rating – warned that a government shutdown would be a “credit negative” event, reported Matt Phillips of Axios. Congress temporarily avoided a government shutdown by passing a continuing resolution that provides funding through mid-November.

By the end of the quarter, optimism that the end of the Fed’s tightening cycle was near had faded amid uncertainty about the strength of the economy, the possibility of a government shutdown, and a growing number of labor disputes. In late September, the Fed released its economic projections, making it clear that an additional rate hike was possible in 2023, and rate cuts were unlikely before 2024.

The Fed’s hawkish outlook helped push stock and bond markets lower. In late September, the S&P 500 Index was down about 7 percent from its July high. From August through September, the yield on the 10-year U.S. Treasury note rose from 4.05 percent to 4.59 percent. Bond prices fall as yields rise.

Last week, despite the strong jobs report bolstering the likelihood of another Fed rate hike, the S&P 500 and Nasdaq Composite Indices moved higher. The Dow Jones Industrial Index lost ground. Yields on U.S. Treasuries generally moved higher over the week.

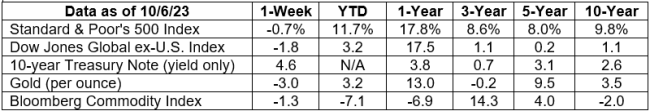

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; U.S. Treasury; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

STRANGE BUT TRUE…The animal world is filled with wonders. For example, National Geographic reports that the world’s lightest mammal is the Bumblebee bat. It weighs in at two grams – about the same as two standard paper clips. See what you know about recent occurrences in the natural world by taking this brief quiz.

- Flamingos that may have been flying from Cuba to the Yucatan were blown off course by Hurricane Idalia. So far, they’ve been found in 12 U.S. states, according to news reports. What is the northernmost state where they have been found?

- Minnesota

- Wisconsin

- Montana

- Alaska

- Scientists believe that the ability to solve problems independently is a sign of intelligence among animals. In a recent study, scientists scattered “puzzle boxes with three differently configured compartments that contained highly aromatic jackfruit” across an area to see whether Asian elephants would be willing and able to open the boxes. How many of the 44 elephants that approached the boxes were able to figure out at least one way to open them?

- 37

- 24

- 11

- 4

- Blue is one of the rarest colors in nature. Last year, explorers in Thailand found a new species of creature with iridescent blue patches on its body. What type of creature was it?

- A sloth

- A snail-eating snake

- A tarantula

- An owl

Weekly Focus – Think About It

Dreams

By Langston Hughes

Hold fast to dreams

For if dreams die

Life is a broken-winged bird

That cannot fly.

Hold fast to dreams

For when dreams go

Life is a barren field

Frozen with snow.

Answers: 1) b; 2) c; 3) c

Best regards,

The Wealth Consulting Group

Sources:

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.html (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-09-23_Historical%20Returns_1.pdf) https://www.reuters.com/markets/us/futures-climb-treasury-yields-ease-ahead-key-inflation-data-2023-09-29/ https://www.newyorkfed.org/markets/reference-rates/effr https://www.reuters.com/markets/rates-bonds/bond-rout-wont-end-fed-balance-sheet-cuts-endgame-bubbling-into-view-2023-10-06/ https://www.cnbc.com/2023/10/06/jobs-report-september-2023.html https://www.bls.gov/news.release/empsit.a.htm https://www.bloomberg.com/news/articles/2023-07-21/us-recession-becomes-closer-call-as-economists-rethink-forecasts?embedded-checkout=true (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-09-23_Bloomberg_US%20Recession%20Becomes%20Closer%20Call_7.pdf) https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023 https://www.axios.com/2023/09/25/government-shutdown-us-credit-rating-moodys https://www.cnbc.com/2023/09/30/government-shutdown-live-updates-congress-faces-funding-deadline.html https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20230920.pdf https://home.treasury.gov/resource-center/data-chart-center/interest-rates/TextView?type=daily_treasury_yield_curve&field_tdr_date_value=2023 https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2023/10-09-23_Barrons_Data_13.pdf) https://kids.nationalgeographic.com/weird-but-true/article/animals https://www.batcon.org/bat/craseonycteris-thonglongyai-2/ https://thingsonascale.com/things-that-weigh-2-grams/#google_vignette https://poets.org/poem/dreams https://www.wisn.com/article/flamingo-sighting-lake-michigan-wisconsin/45269142# https://www.sciencedaily.com/releases/2023/09/230928152537.htm https://www.goodnewsnetwork.org/discovery-of-electric-blue-tarantula-stuns-scientists-who-auction-naming-rights-for-charity/