Weekly Market Commentary 06-21-2021

The Markets

Is that a hawk?

The Federal Reserve Open Market Committee (FOMC) met last week. They get together eight times a year to review current economic and financial conditions, assess risks to price stability and economic growth, and adjust monetary policy accordingly.

When the Federal Reserve raises the fed funds rate to keep inflation and economic growth in check, it is ‘hawkish’. When the Fed lowers the fed funds rate to encourage inflation and economic growth, it is ‘dovish’.

Last week, the FOMC appeared to veer toward a more hawkish policy.

The FOMC did not change the current policy. However, the dot plot – a chart that reflects meeting participants’ expectations for the fed funds rate in the years ahead – showed a majority leaning toward two rate hikes in 2023. That was new. The March 2021 dot plot, which showed no rate hikes before 2024, reported Ben Levisohn, Nicholas Jasinski, and Barbara Kollmeyer of Barron’s.

Financial market suspicions that a hawkish turn might be underway were confirmed on Friday when St. Louis Federal Reserve President James Bullard, who will become a voting FOMC member next year, told Rebecca Quick of CNBC’s Squawk Box:

“We were expecting a good year, a good reopening. But this is a bigger year than we were expecting, more inflation than we were expecting, and I think it’s natural that we’ve tilted a little bit more hawkish here to contain inflationary pressures.”

Financial markets weren’t thrilled by the news.

“The increasingly hawkish tilt caused stocks that benefit from a stronger economy and hotter inflation – the financials, energy, and materials sectors among them – to get hit hard, and has sparked a resurgence in the tech trade. Growthier tech stocks again beat cyclical and value stocks on Friday…All 11 sectors of the S&P 500 finished in the red on Friday,” reported Barron’s.

Major United States stock indices finished the week lower, and the Treasury yield curve flattened somewhat, suggesting slower economic growth may be ahead.

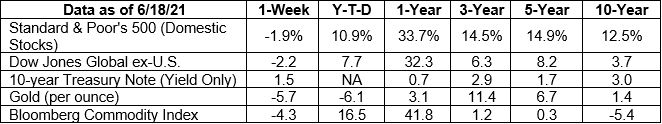

(The one-year numbers in the scorecard below remain noteworthy. They reflect the strong recovery of U.S. stocks from last year’s coronavirus downturn to the present day.)

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; Federal Reserve Bank of St. Louis; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

What’s the difference?

Over the next few months, we’ll probably begin to hear more about the deficit, the debt, and the debt limit. Here’s a primer to help you keep them straight.

The U.S. deficit: When the United States has a deficit, it means the government spent more than it took in. When the government spends less than it takes in, it is called a surplus. Deficits might be helpful. For instance, when a pandemic occurs, deficit spending may help stabilize a wobbly economy.

The U.S. government engaged in deficit spending in 2020 and early 2021 to support Americans, businesses, and the economy. It spent $6.6 trillion and took in $3.4 trillion in revenue ($1.3 trillion was payroll taxes that fund Medicare and Social Security). As a result, the budget deficit was $3.1 trillion in 2020.

The national debt: Whenever the U.S. spends more than it takes in, the national debt increases. The debt is the amount the U.S. government owes. Every annual deficit adds to the debt and every annual surplus reduces it. There are a variety of ways to measure the national debt. At the end of the first quarter of 2021, the national debt was:

- More than $28 trillion

- 127.5 percent of gross domestic product (GDP)

So, how much debt is too much? Research suggests the answer depends on a country’s economic growth rate, the level of interest rates, and the strength of its institutions and central bank, reported Heather Hennerich of the St. Louis Federal Reserve’s Open Vault Blog.

The debt limit: When a government runs a deficit, it borrows money to keep operating. The amount that it can borrow is determined by the debt limit, a.k.a., the debt ceiling. The debt limit is the amount of money the government is authorized to borrow to meet its obligations, such as Social Security and Medicare benefits, military salaries, national debt payments, income tax refunds, and other commitments.

“Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit,” reported the U.S. Treasury.

The debt ceiling was suspended in 2019, and the suspension expires on July 31, 2021.

Weekly Focus – Think About It

“If you choose to not deal with an issue, then you give up your right of control over the issue and it will select the path of least resistance.” –Susan Del Gatto, Author

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.federalreserve.gov/monetarypolicy/fomc.htm

https://www.thestreet.com/video/what-is-dovish-hawkish-federal-reserve-14921836

https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20210616.htm [Figure 2]

https://www.barrons.com/articles/stock-market-news-51624018547?mod=article_inline (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/06-21-2021_Barrons_Dow%20Has%20Worst%20Week%20in%208%20Months.pdf)

https://www.barrons.com/market-data (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/06-21-2021_Barrons_Data%20Overview.pdf)

https://www.investopedia.com/terms/f/fiscaldeficit.asp

https://www.cbo.gov/publication/57170

https://www.investopedia.com/updates/usa-national-debt/

https://fred.stlouisfed.org/series/GFDEBTN

https://fred.stlouisfed.org/series/GFDEGDQ188S

https://www.stlouisfed.org/open-vault/2020/october/debt-gdp-ratio-how-high-too-high-it-depends

https://www.rollcall.com/2021/06/14/democrats-have-no-easy-options-for-raising-the-debt-limit/

https://www.goodreads.com/quotes/tag/problem-solving