Company Stock in Your 401(k)? Consider Net Unrealized Appreciation.

|

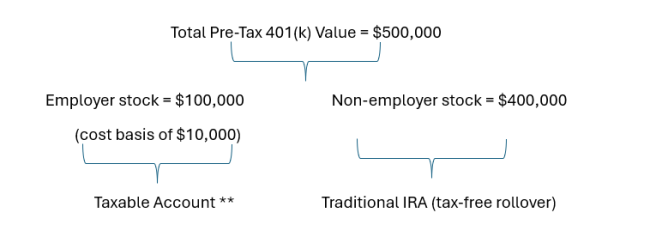

**Tax treatment:

- $10,000 cost basis taxed as ordinary income in year of distribution

- $90,000 unrealized gain taxed as long-term capital gain whenever stock is sold

1. Qualifications: There are certain requirements for utilizing the NUA strategy, such as distributing the entire vested balance of your 401(k) in one tax year, distributing all the employer’s qualified plans of the same kind (even if only one holds company stock), transferring the employer stock in-kind, and incurring a qualifying event such as separating from service, becoming disabled, or obtaining age 59 1/2. There are strict rules enforced by the IRS regarding the criteria to qualify for the NUA election, so it is best to consult with your tax professional before implementing this strategy, or your entire company stock distribution could become subject to ordinary income taxes.

2. Considerations: While the NUA strategy can potentially result in tax savings, it's important to consider your individual financial situation, including your current and future projected tax brackets, investment goals, and overall portfolio diversification before deciding to implement it. There are certain situations in which an NUA strategy may not be favorable (i.e. the cost basis of your employer stock is high relative to its fair market value, your projected tax rate in the future is lower than it is today, you will lose out on the tax-deferral of keeping it in your 401(k) and the ability to rebalance tax-free, etc.), which is why your long-term outlook must be carefully evaluated.

As always, be sure to consult with your financial advisor and tax professional to ensure the NUA strategy aligns with your specific circumstances and goals.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through WCG Wealth Advisors, LLC a Registered Investment Advisor. The Wealth Consulting Group and WCG Wealth Advisors, LLC are separate entities from LPL Financial.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

This information is not intended to be a substitute for specific individualized tax advice. We

suggest that you discuss your specific tax issues with a qualified tax advisor.

|

|